Imagine if your IFRS 16 reporting could be both simple and efficient?

With our solution, it’s a reality. Here’s what you can expect:

Ensure accurate calculations

Excel might feel straightforward at first, but as it becomes more dependent on manual input, the risk of errors increases. We deliver precise and reliable calculations, so you can focus on what matters most.

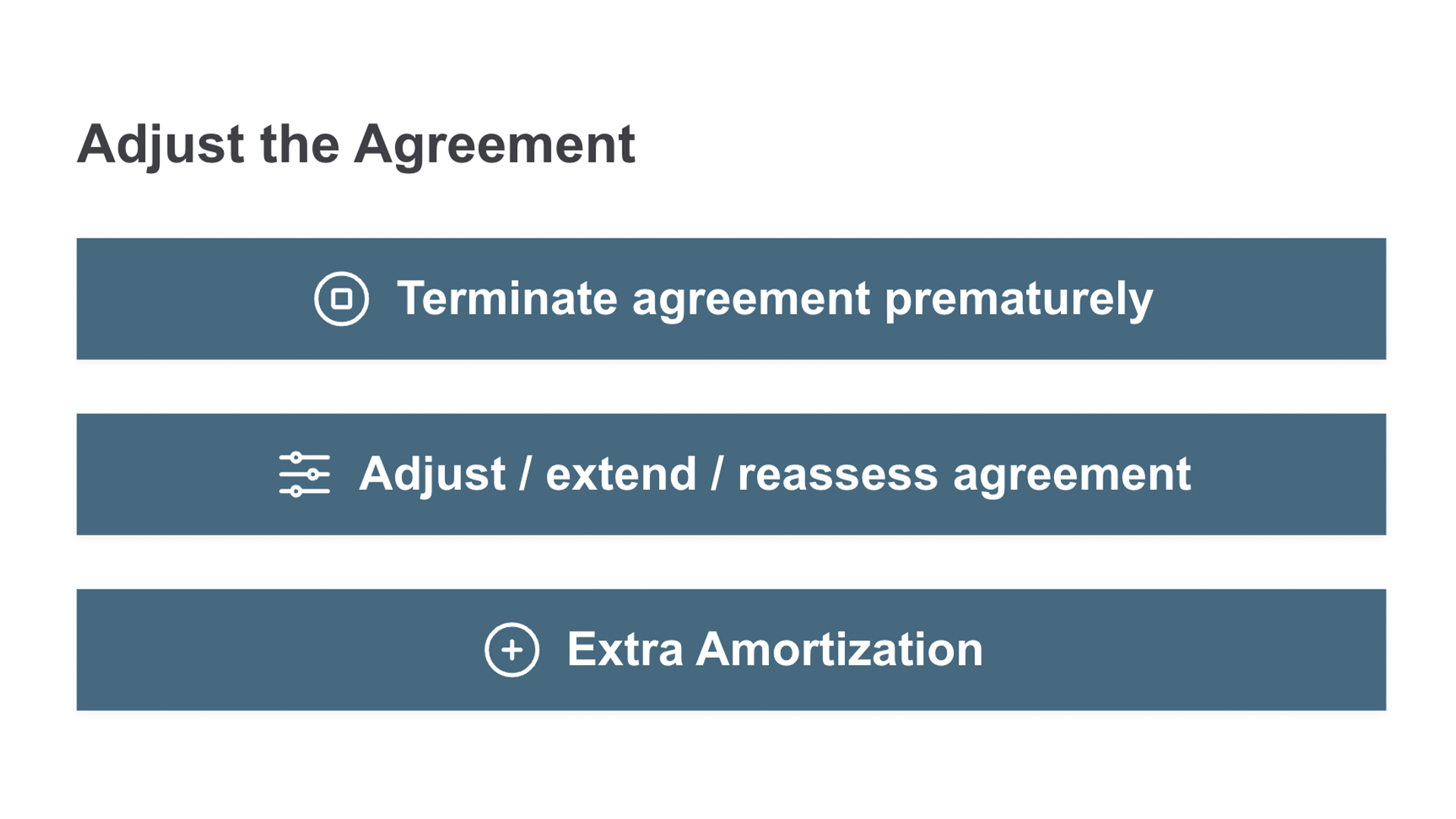

Adjustment features

Indexation, extensions, or early terminations? No problem. Our solution ensures accurate calculations and clear traceability with user-friendly tools.

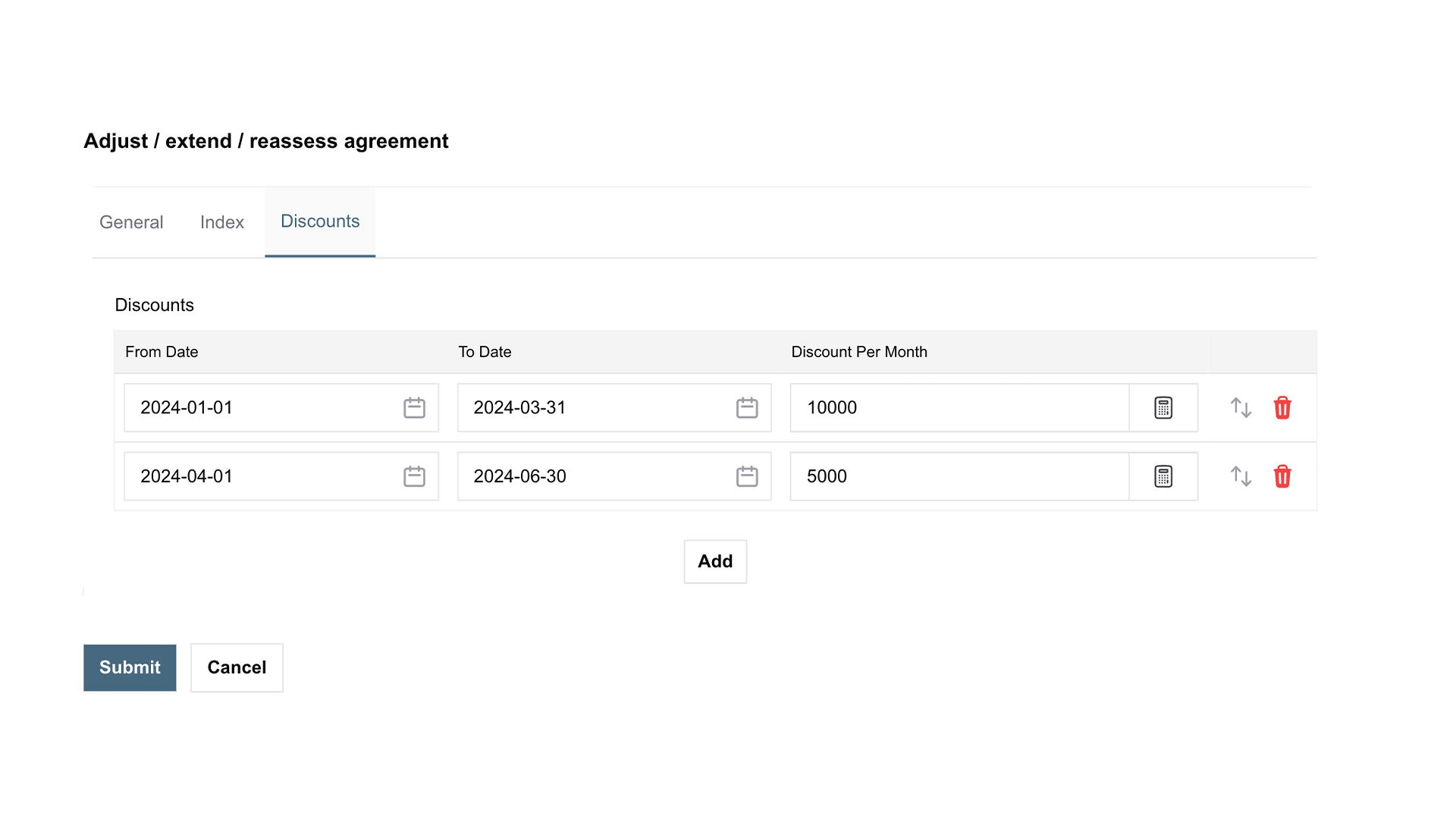

Precise calculations for discounts and variable costs

All contract terms are included to ensure accurate calculations. You can easily manage discounts, initial costs, and annual fee adjustments—both those set at the start of the contract and those that come later, like index changes.

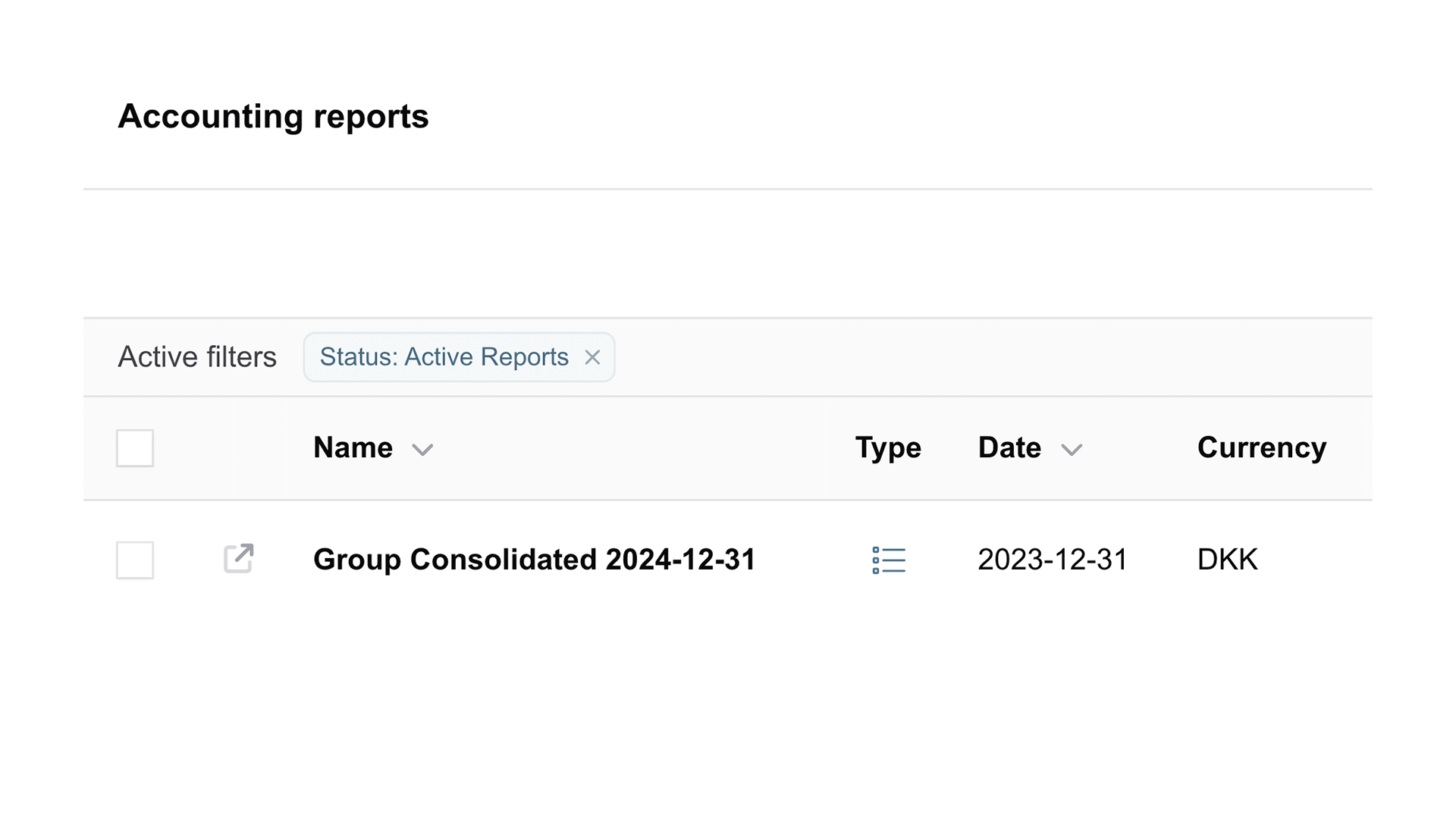

Complete flexibility in group reporting

Need reports at the group level or based on specific requirements? Easily generate flexible reports by company, cost center, or asset type. Plus, the reports can be converted into any currency and provided as an import file for your consolidation system – ensuring simple and efficient management.

IFRS 16 Guide

Download our guide to accurate IFRS 16 accounting

This guide provides a overview of the lease accounting standard IFRS 16 – and why it continues to be a pain point for many organizations. We outline the most common challenges companies face in lease accounting and offer actionable strategies to help you streamline compliance, improve reporting accuracy, and reduce risk.

Inside the guide, you’ll learn:

-

How to account for modifications and reassessments during the life of a lease.

-

The financial risks of losing control over your lease portfolio.

-

The challenges of managing leases with spreadsheets.

-

How to create a structured process for lease documentation.

Curious to learn more?

With Leasify, the risk of inaccuracies is reduced. Reports are consistent, secure, fast, and fully compliant with both IFRS 16 and audit requirements. Fill in your details and we’ll get in touch.

.png?width=2146&height=574&name=Boozt_Logo_Pos%20(1).png)

-2.png?width=1181&height=210&name=didriksons_logo_rgb_black_left_primary%20(kopia)-2.png)

.png)