Are you affected by the International Financial Reporting Standard 16?

IFRS 16, introduced in 2019, is an international accounting standard that has significantly impacted companies' balance sheets. It is now mandatory...

When an IFRS 16 lease agreement begins, the initial measurement must be determined based on the company’s future lease payments. This requires gathering all known payments and contract terms and discounting them using the appropriate rate. In this article, we explain what needs to be included from the outset and how the calculation is performed in practice.

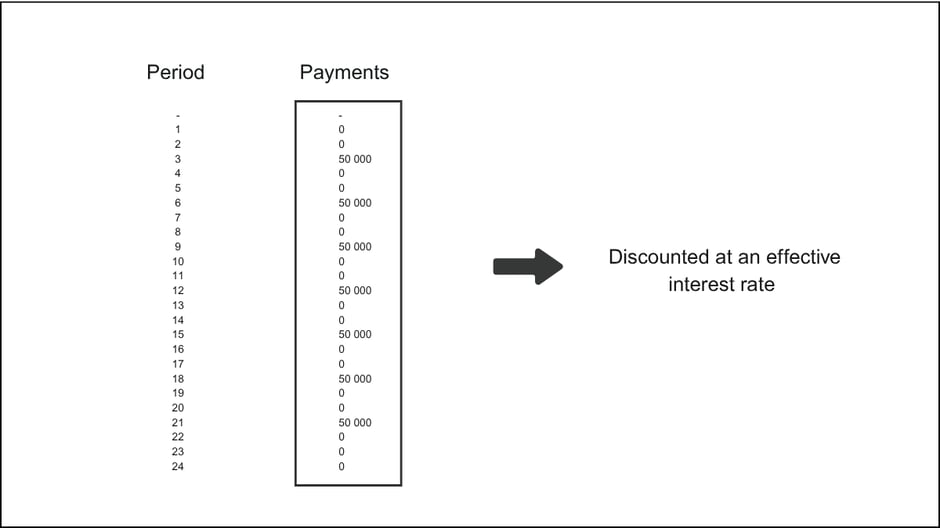

When an IFRS 16 lease is initiated, the initial measurement needs to be determined. To calculate this amount, all future lease payments that are known at the commencement date must be identified, including the timing of each payment.

To determine the initial measurement, the lease payments are discounted using either the incremental borrowing rate or the interest rate implicit in the lease. The resulting present value forms the basis for recognizing both the lease asset and the lease liability. Because the calculation is driven by future payment obligations, any known factors such as initial discounts, scheduled price increases, or other contractual terms must be included from the outset. Everything known at the commencement date must be reflected, whether the lease relates to an asset with a clear purchase value, like a vehicle, or to a property with no readily identifiable market value.

In both cases, the lease asset and liability are measured based on the company’s future payment obligations, including any reasonably certain renewal options. The calculation uses a discount rate, and for each reporting period an effective interest rate is applied to update the carrying amount. Each payment is then allocated between interest expense and principal reduction. As a result, the lease liability decreases over time, while the interest portion reflects the cost of financing the right to use the asset.

IFRS 16, introduced in 2019, is an international accounting standard that has significantly impacted companies' balance sheets. It is now mandatory...

When Infrakraft, Swedish company, chose Leasify to manage its leasing and rental agreements under IFRS 16 and Local GAAP, it wasn’t just about...

When Avoki, a leading IT provider in the Nordics, realized their manual management of leasing and rental agreements in Excel was becoming...